It appears you don't have a PDF plugin for this browser. Please use the link below to download 2018-pennsylvania-form-pa-40-t.pdf, and you can print it directly from your computer.

- Pa State Income Tax Gambling Winnings 2016

- Pa State Income Tax Gambling Winnings 2017

- Gambling Winnings In Vegas And State Tax

- Oklahoma Income Tax Gambling Winnings

More about the Pennsylvania Form PA-40 T

eFile your Pennsylvania tax return now

eFiling is easier, faster, and safer than filling out paper tax forms. File your Pennsylvania and Federal tax returns online with TurboTax in minutes. FREE for simple returns, with discounts available for Tax-Brackets.org users!

IL is the ONLY state that DOES NOT allow you a credit for taxes paid to another state on gambling winnings. Their stance is that IL does not tax nonresidents for gambling winnings they win in IL and IF other state followed this same rule, they would not tax IL residence.

File Now with TurboTax

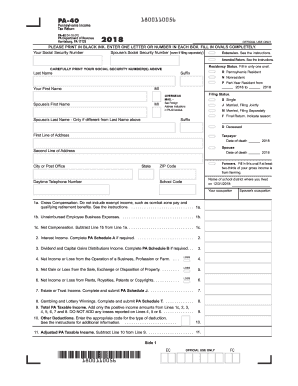

We last updated Pennsylvania Form PA-40 T in January 2019 from the Pennsylvania Department of Revenue. This form is for income earned in tax year 2019, with tax returns due in April 2020. We will update this page with a new version of the form for 2021 as soon as it is made available by the Pennsylvania government.

Other Pennsylvania Individual Income Tax Forms:

- Download or print the 2018 Pennsylvania (PA Schedule T - Gambling and Lottery Winnings) (2018) and other income tax forms from the Pennsylvania Department of Revenue.

- Gambling might be an adrenaline rush, but your winnings are subject to the federal income tax and this can throw a damper on things. Gambling winnings consist of income from wagers and bets, lotteries, sweepstakes, raffles, prizes, awards, and contests.

In addition to information about Pennsylvania's income tax brackets, Tax-Brackets.org provides a total of 175 Pennsylvania income tax forms, as well as many federal income tax forms. Here's a list of some of the most commonly used Pennsylvania tax forms:

| Form Code | Form Name |

|---|---|

| Form PA-40 | Pennsylvania Income Tax ReturnTax Return |

| Form PA-40 PA-V | PA-40 Payment VoucherVoucher |

| Form 40 Instruction Booklet | Income Tax Instruction Booklet |

| Form PA-40 UE | PA Schedule UE - Allowable Employee Business Expenses |

| Form PA-40 SP | PA Schedule SP - Special Tax Forgiveness |

Disclaimer: While we do our best to keep Form PA-40 T up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Is this form missing or out-of-date? Please let us know so we can fix it!

Tax Form Sources:

- Pennsylvania Department of Revenue ( http://www.revenue.state.pa.us/ )

- Department of Revenue Income Tax Forms ( http://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Pages/default.aspx )

Winning the Lottery or scoring on a sports wager can change your life in profound ways. Congratulations on your lucky break!

Just remember that your good fortune includes a responsibility to pay taxes and fees on those winnings.

Gambling Winnings:

In 2018, Governor Phil Murphy signed a law that authorized legal sports betting in New Jersey. The law (A4111) allows people, age 21 and over, to place sports bets over the internet or in person at New Jersey's casinos, racetracks, and former racetracks. Sports betting is now among the many forms of gambling winnings that are subject to the New Jersey Gross Income Tax, including legalized gambling (sports betting, casino, racetrack, etc.) and illegal gambling.

Lottery:

New Jersey Lottery winnings from prize amounts exceeding $10,000 became subject to the Gross Income Tax in January 2009.

Withholding Rate from Gambling Winnings

New Jersey Income Tax is withheld at an amount equal to three percent (3%) of the payout for both New Jersey residents and nonresidents (N.J.S.A. 54A:5.1(g)).

Withholding Rate from Lottery Winnings

The rate is determined by the amount of the payout. If a prize is taxable (i.e., over $10,000), the entire amount of the payout is subject to withholding, not just the amount in excess of $10,000. The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows:

- 5% for Lottery payouts between $10,001 and $500,000;

- 8% for Lottery payouts over $500,000; and

- 8% for Lottery payouts over $10,000, if the claimant does not provide a valid Taxpayer Identification Number.

Companies that obtain the right to Lottery payments from the winner and receive Lottery payments are also subject to New Jersey withholdings. Each company is required to file for a refund of the tax withheld, if applicable.

Lottery

New Jersey Lottery winnings from prize amounts exceeding $10,000 are taxable. The individual prize amount is the determining factor of taxability, not the total amount of Lottery winnings during the year.

Pa State Income Tax Gambling Winnings 2016

- For example, if a person won the New Jersey Lottery twice in the same year, and the winning prize amounts were $5,000 and $6,000, these winnings would not be subject to New Jersey Gross Income Tax. However, if that person won the Lottery once and received a prize of $11,000, the winnings would be taxable.

- This standard for taxability applies to both residents and nonresidents.

- The New Jersey Lottery permits donating, splitting, and assigning Lottery proceeds to someone else or to a charity. If you choose to donate, split, or assign your Lottery winnings, in whole or in part, the value is taxable to the recipient in the same way as it is for federal income tax purposes.

Gambling and Lottery

Making Estimated Payments

If you will not have enough withholdings to cover your New Jersey Income Tax liability, you must make estimated payments to avoid interest and penalties. For more information on estimated payments, see GIT-8, Estimating Income Taxes.

Out-of-State Sales:

Out-of-state lottery winnings are taxable for New Jersey Gross Income Tax purposes regardless of the amount.

Gambling winnings from a New Jersey location are taxable to nonresidents. Gambling includes the activities of sports betting and placing bets at casinos and racetracks.

Calculating Taxable Income

You may use your gambling losses to offset gambling winnings from the same year as long as they do not exceed your total winnings. If your losses were greater than your winnings, you cannot report the negative figure on your New Jersey tax return. You must claim zero income for net gambling winnings. For more information, see TB-20(R), Gambling Winnings or Losses.

Pa State Income Tax Gambling Winnings 2017

You may be required to substantiate gambling losses used to offset winnings reported on your New Jersey tax return. Evidence of losses can include your losing tickets, a daily log or journal of wins and losses, canceled checks, notes, etc. You are not required to provide a detailed rider of gambling winnings and losses with your New Jersey tax return. However, if you report gambling winnings (net of losses) on your New Jersey return, you must attach a supporting statement indicating your total winnings and losses.

Gambling Winnings In Vegas And State Tax

Reporting Taxable Winnings

Include taxable New Jersey Lottery and gambling winnings in the category of “net gambling winnings” on your New Jersey Gross Income Tax return.

Comments are closed.